But exactly how create this type of funds impression your credit score? Let’s consider a number of the potential confident and you will negative effects of signature loans.

Can help you Establish an accountable Credit score Credit history bureaus usually do not let us know specifically the way they calculate borrowing from the bank score, however, i do know that having a long reputation of sensibly repaying the money you owe usually leads to a high credit rating. Taking out that loan and you may making your instalments punctually and you may in full each month makes it possible to build an accountable borrowing record. Definitely, if you don’t create your payments on time plus complete every month, you could easily hurt your score, too.

Get Change your Borrowing Blend Creditors typically need to lend money to people who’re in a position in order to responsibly create a wide array of different varieties of borrowing. Eg, credit cards is a kind of rotating borrowing from the bank, that is generally a reputation contract you to lets you obtain a great specific amount of cash monthly so long as you spend they right back. To be able to carry out revolving borrowing from the bank is useful, however some financial institutions and additionally want to see that one can manage repayment borrowing from the bank, also. Payment borrowing from the bank, that’s efficiently financing, pertains to credit a lump sum at the start then paying down one debt over the years. This shows another type of types of accuracy as a borrower to help you loan providers, thus cash advance near me in control management of installment borrowing from the bank may help replace your credit rating throughout the years.

Would be Always Consolidate & Pay Debt Many people use signature loans so you can consolidate most other debt, that may ultimately help improve your credit score. Merging personal debt alone doesn’t necessarily provides an optimistic impression on the borrowing from the bank. But if consolidating debt out-of various loan providers on the one mortgage renders it simpler to repay the debt over the years, next this can often help improve your credit rating. Once more, otherwise take control of your debt consolidation mortgage responsibly, it will damage your credit. But settling financial obligation is normally the great thing regarding the sight out-of credit reporting agencies.

As well as happening having whatever credit line, discover prospective results of unsecured loans. Any of these negative effects could be extremely bad for your own monetary lives, making it crucial that you totally consider carefully your power to pay-off your debts promptly before you sign one mortgage preparations.

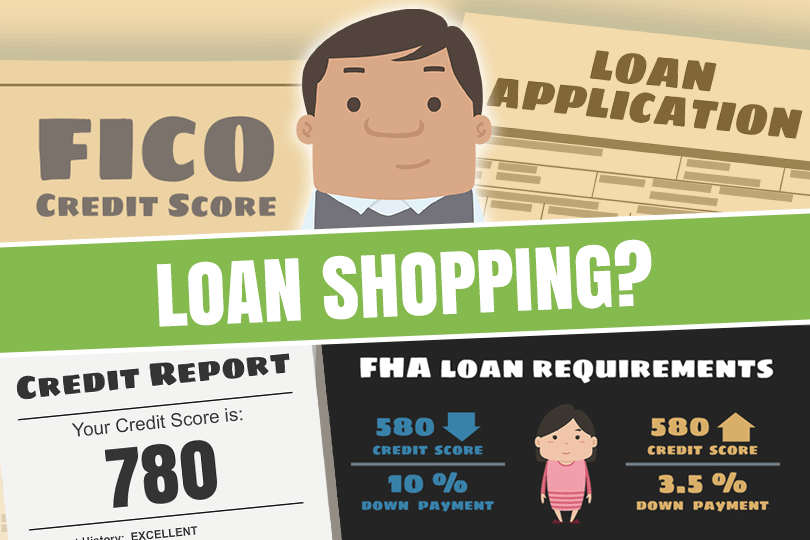

1st Decrease in your Credit history Most people realize that the credit rating dips because of the 5 to help you 15 products regarding the days after they submit an application for an individual financing. It doesn’t eventually anyone, but you will fundamentally look for a world reduction of their borrowing get after you discover an alternate line of credit. That’s because lenders more often than not carry out a difficult query on your own credit rating using your application for the loan. That it tough inquiry stays on your own report for approximately a couple of years also it can alert loan providers off of giving you a whole lot more credit out of anxiety that you will never manage to repay all of that loans. Fortunately, having in charge repayment, extremely fico scores get well inside a few months so you’re able to annually away from a difficult query.

Additional Will set you back & Desire Costs Even if it’s true you to definitely signature loans normally have down rates than playing cards and you can payday loans, they have been not really cheaper. Credit currency ensures that you’ll be purchasing additionally date than you would enjoys if you had the cash readily available to invest in your own efforts to start with. To some extent, this is just the cost of conducting business within progressive globe, but it is something to remember one which just go shopping for financing.